The Most Common Type of Mortgage

Key Loan Details (Purchase or Refinance)

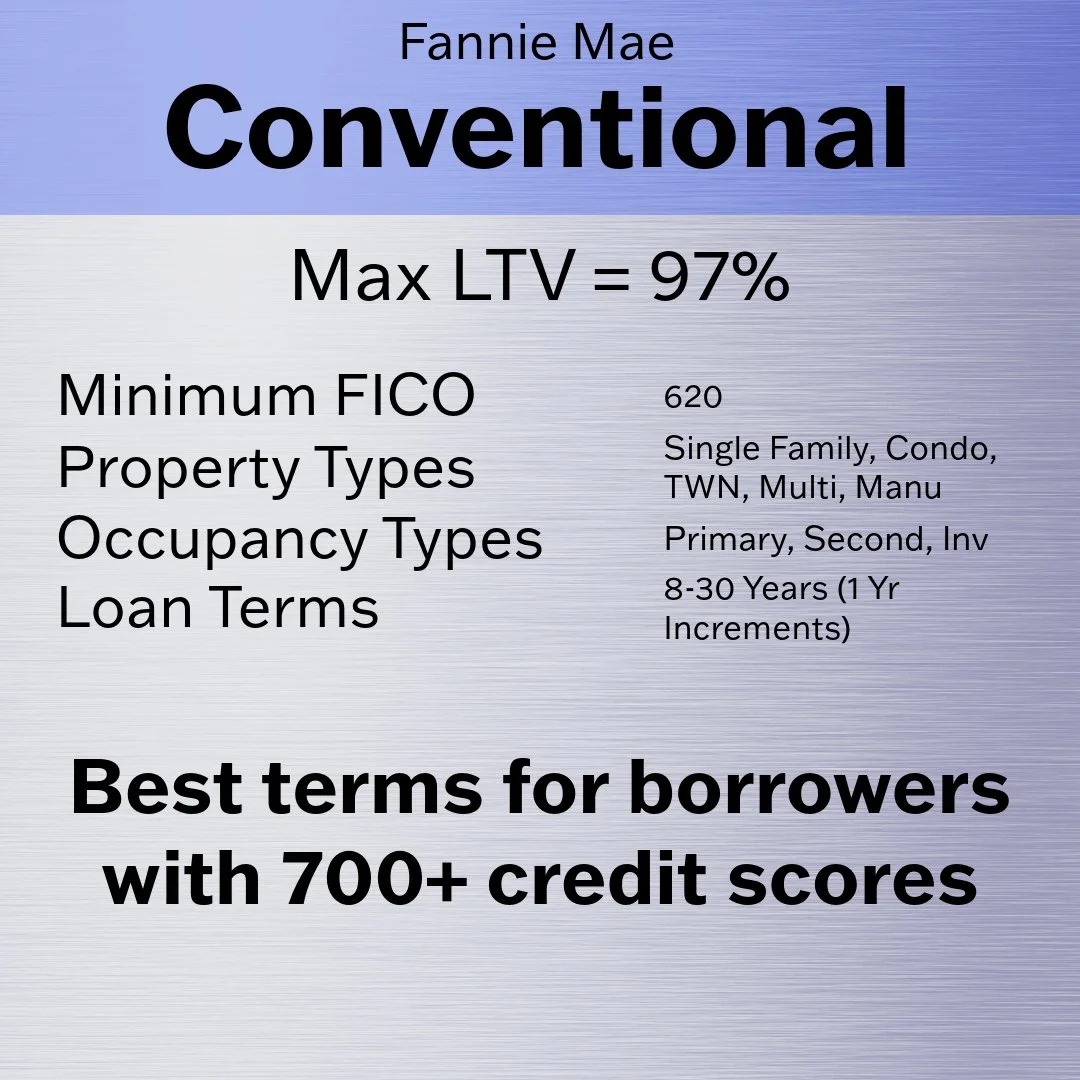

Best Terms for Most Borrowers: It’s the most popular because it offers the best terms for most people. That means the lowest payment for the least cost.

HomeReady: A special type of Conventional loan only for First Time Home Buyers making less than 80% Area Median Income. Fannie Mae waives significant pricing adjustments for first time home buyers; that means you get a better rate.

HomeStyle: Fannie Mae’s renovation loan program designed to finance renovation costs. Your down payment is a percentage of the completed value after renovations, as little as 3%.

Funding Sources: Down payments and closing costs can be covered through gifts, grants, or Community Seconds®, with no minimum personal contribution required.

Navigating the Application Process

Step 1: Have A Conversation

Initial Consultation: Start by having a conversation with us about which Conventional loan program might be best for you. Learn about our consultations on our Services page, or click on the following link to schedule a time to speak with us - Book Appointment

Step 2: Pre Approval or Application

Formal Pre-Approval or Application: Submit a formal loan application. We will guide you through the process and inform you of any additional scenario-specific requirements. You can click here to Apply Online Now.

Documentation Required:

Income Verification: Recent pay stubs, W-2 forms, and for certain types of income we’ll also collect tax returns for the past 1 or 2 years.

Other Income Documents: Documentation to support other sources of income such as retirement statements, Social Security Awards letters, or any other documents proving receipt of income.

Asset Documentation: Bank statements or other assets to demonstrate you have the funds for the down payment and closing costs. If you are refinancing, it is likely that you will not need to provide bank statements.

Credit Report: We will pull your credit report, but it’s also good to review your credit in advance.

Property Information: Details about the property you currently own or intend to purchase, including a sales contract if you're already under contract.

Photo ID: We must reliably identify all borrowers on any loan application.

Step 3: Homeownership Education (If Applicable)

Requirement for First-Time Homebuyers: At least one borrower on the application must complete a homeownership education course.

Fannie Mae HomeView®: This online course is free, fulfills the education requirement and prepares you for responsible homeownership. It covers budgeting, financing, home maintenance, and other key aspects of owning and maintaining a home. You do not have to wait to take this class, the certificate is good for 12 months.

Step 4: Loan Processing and Underwriting

Loan Set Up: After you successfully execute a purchase contract on a home, or decide to move forward with refinancing, we’ll begin the loan setup phase. This is where we structure your loan, shop lenders for you, and review all of your documentation one more time to make sure you’re set up for success. We’ll focus heavily on loan requirements, terms, costs, payments, and final numbers at closing, so you get a clear picture of what lies ahead. After discussing all the details thoroughly, we will complete the loan application and prepare it for submission.

Automated Underwriting: One of the first steps in the loan approval process is submitting your application to an Automated Underwriting System (AUS) that evaluates your creditworthiness and eligibility based on predefined criteria. The AUS will generate a decision and a list of requirements. The results serve as the roadmap to reach final approval.

Loan Disclosures: Your official loan application and associated disclosures will be generated and sent for you to sign electronically. We’ll guide you through signing these and once completed we’ll get your file ready for underwriting.

Underwriting: We will submit your application and documentation to underwriting for approval. The underwriter reviews your financial information, ensures that we meet all guideline requirements, and verifies the results of the automated underwriting system (AUS). This process may take several days or weeks, depending on the complexity of your situation. During this time, we may need to go back and forth with you and the underwriter to clear any conditions or questions that arise. We will communicate with you regularly and keep you updated on the status of your approval.

Appraisal: An appraisal to assess the property's value and compliance with the loan program's guidelines and standards will be scheduled. This step can occur either before receiving conditional approval or, in many cases, after conditional approval has been issued by the underwriter.

Title Work: We will order title insurance, obtain a 12-24 month chain of title, receive wiring instructions, a closing protection letter, and acquire a tax certification to confirm the accuracy of property taxes. All these steps are taken to ensure that the title is transferred to you free of encumbrances, and that neither you nor the lender is at risk. Essentially, we are verifying that the title company has executed their duties correctly.

Step 5: Loan Approval and Closing

Loan Approval: Once all of your underwriting conditions are cleared, you’ll receive full loan approval. That means you’re almost out of the woods.

Clear to Close: After loan approval we’ll work to do just a few more things in order to get the final ok from the lender that we are completely in the clear to draw documents. These are the magic words, clear to close, that we always want to hear in the mortgage industry. This means the only step left is to draw up the final paperwork for you to sign.

Closing: At closing, you'll sign all necessary paperwork, finalize the loan, and take ownership of your new home, or complete your refinance.