Unlocking the Benefits of HomeReady

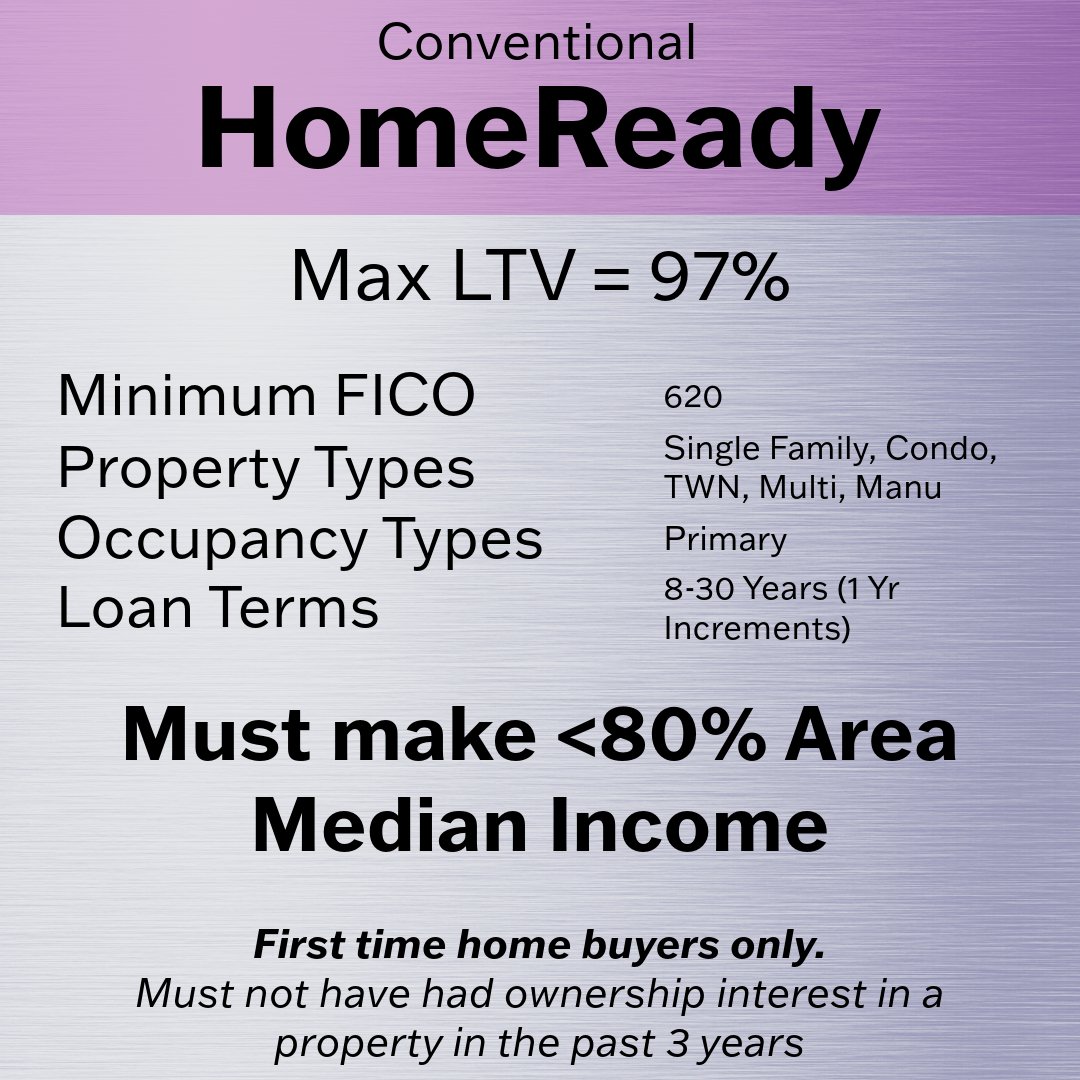

Key Loan Details

First Time Homebuyer Requirement: Only for first time home buyers. (Home Possible by Freddie Mac does not have this requirement)

Required Education: Fannie Mae requires the completion of first time home buyer education. (HomePossible by Freddie Mac does not require education if at least one borrower has owned a home in the past)

Pricing Adjustment Waivers: Fannie Mae waives many pricing adjustments for first time home buyers, that means you get a better rate.

Funding Sources: Down payments and closing costs can be covered through gifts, grants, or Community Seconds®, with no minimum personal contribution required.

Rental Income: Includes potential rental income from a boarder or an accessory dwelling unit (ADU) in qualifying income calculations, broadening eligibility.

Mortgage Insurance: Reduced coverage requirement for loans above 90% LTV.

Navigating the Application Process

Step 1: Eligibility Check

Initial Consultation: Start by having a conversation about the HomeReady loan program to discuss your financial situation and homeownership goals. Click here to schedule a time to speak with us - Book Appointment

Eligibility Verification: Use the AMI lookup tool (https://ami-lookup-tool.fanniemae.com) or consult with your lender to verify if you meet the income eligibility requirements based on the area median income (AMI) for the property's location.

Step 2: Pre Approval Application

Formal Pre-Approval Application: Submit a formal loan application. We will guide you through the process and inform you of any additional scenario-specific requirements. You can click here to Apply Online Now.

Documentation Required:

Income Verification: Recent pay stubs, W-2 forms, or tax returns for the past 2 years to verify your income and employment status.

Asset Documentation: Bank statements or other assets to demonstrate you have the funds for the down payment and closing costs.

Credit Report: We will pull your credit report, but it’s also good to review your credit in advance.

Property Information: Details about the property you intend to purchase, including a sales contract, if you're already under contract.

Photo ID: We must identify you.

Other Income Documents: Any other documentation to support other sources of income.

Step 3: Homeownership Education

Requirement for First-Time Homebuyers: At least one borrower on the application must complete a homeownership education course.

Fannie Mae HomeView®: This online course is free and fulfills the education requirement and prepares you for responsible homeownership. It covers budgeting, financing, home maintenance, and other key aspects of owning and maintaining a home. You do not have to wait to take this class, the certificate is good for 12 months.

Step 4: Loan Processing and Underwriting

Loan Set Up: After you successfully execute a purchase contract on a home we’ll begin the loan setup phase. This is where we structure your loan, shop lenders for you, and review all of your documentation one more time to make sure you’re set up for success. We’ll focus heavily on loan terms, costs, payments, and total cash due at closing so you get a clear picture of what lies ahead.

Automated Underwriting: One of the first steps in the loan approval process is submitting your application to an Automated Underwriting System (AUS) that evaluates your creditworthiness and eligibility based on predefined criteria. The AUS will generate a decision and a list of required documents for verification. Once we receive the AUS decision, we will proceed to verify the accuracy of the information and comply with the document requests. Automated decisions give borrowers more certainty, but inputs must still be verified.

Loan Disclosures: Your official loan application and associated disclosures will be generated and sent for you to sign electronically. We’ll guide you through signing these. Once these are completed we’ll get your file ready for underwriting.

Underwriting: We will submit your application and documentation to underwriting for approval. The underwriter reviews your financial information, and ensures that we meet all guideline requirements, and verifies the results of the automated underwriting system (AUS). This process may take several days or weeks, depending on the complexity of your situation and the timeline of your purchase contract. During this time, we may need to go back and forth with you and the underwriter to clear any conditions or questions that arise. We will communicate with you regularly and keep you updated on the status of your approval.

Appraisal: An appraisal to assess the property's value and compliance with the loan program's guidelines and standards will be scheduled. This step can occur either before receiving conditional approval or, in many cases, after conditional approval has been issued by the underwriter.

Step 5: Loan Approval and Closing

Loan Approval: Once all of your underwriting conditions are cleared you’ll receive full loan approval. That means you’re almost out of the woods.

Clear to Close: After loan approval we’ll work to do just a few more things in order to get the final ok from the lender that we are completely in the clear to draw documents. These are the magic words, clear to close, that we always want to hear in the mortgage industry. This means the only step left is to draw up the final paperwork for you to sign.

Closing: At closing, you'll sign all necessary paperwork, finalize the loan, and take ownership of your new home.

References