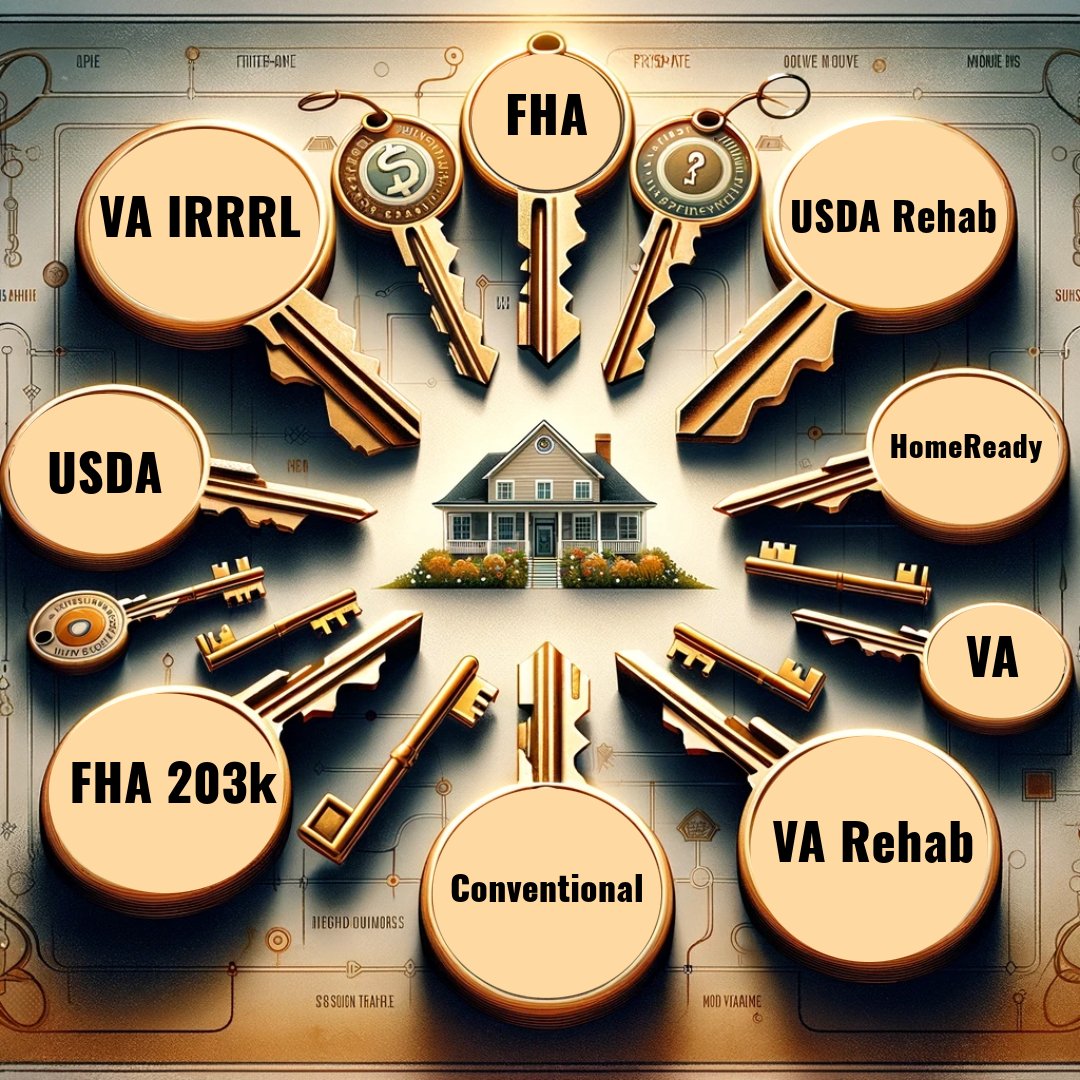

All the Most Popular Loan Types Under One Roof!

-

The best terms for well-qualified borrowers. If Fannie and Freddie do it, then we do it. Standard, Renovation, Construction, and Affordable options. As little as 3% down, possibly less with down payment assistance.

-

Purchase or build your dream home with as little as 3.5% down with 580+ credit. 500+ credit score if you have at least 10% down.

Take cash out, finance home improvements, or do a streamlined refinance without the need for an appraisal, credit or income documents.

-

Eligible veterans can purchase a home with $0 down and no minimum credit score requirement. Get cash out for any reason up to 100% of your property’s value, purchase and renovate, or do an Interest Rate Reduction Refinance Loan. If VA does it, we have it available for our veterans. Thank you for serving, let us serve you now.

-

Buy or build a home in a designated rural area. Get money for renovations or streamline refinance into a lower rate from one USDA loan to another.

-

We offer a variety of highly competitive jumbo loan options tailored to meet your unique financial needs. Each loan is specific to individual lenders, resulting in a range of and rates and fees. Due to this dynamic nature and variability, we cannot provide detailed information on our website. Our dedicated team is here to guide you through the process, offering personalized assistance to help you find the perfect loan solution. To explore the best rates and terms available, please contact us directly.

-

Understanding that traditional loans don’t fit everyone's circumstances, our Non-QM loans fit various niche needs. We offer Debt Service Coverage Ratio (DSCR) loans, bank statement loans, and other private and portfolio options that can be useful tools in the right situation.

This is a complex market segment and we only use these loans if we’ve exhausted more favorable options. These products change frequently, please inquire with your specific situation to learn more about what might be available to you.