Helping Our Nations Veterans

Key Loan Details (Purchase)

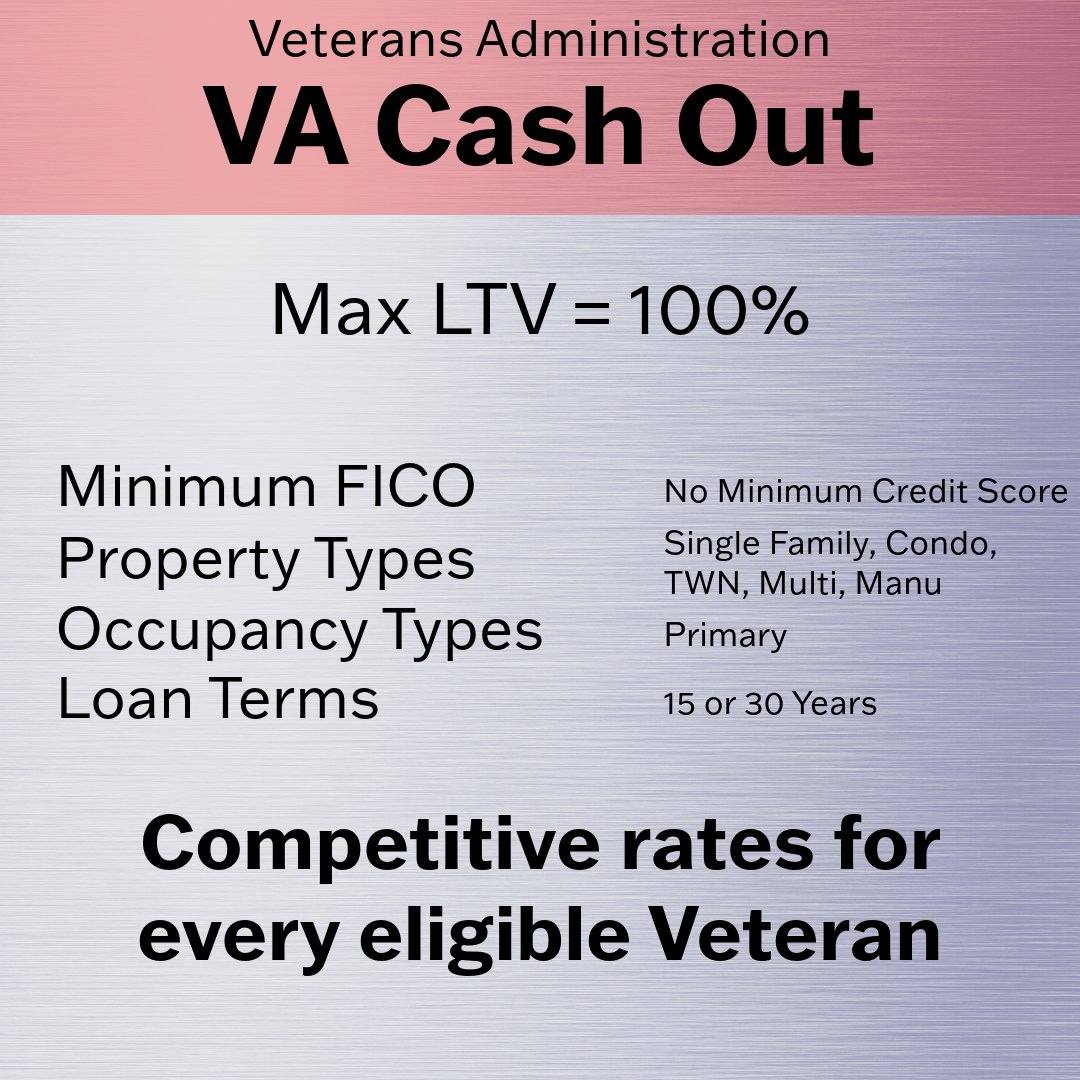

Cash Out Up to 100% of Your Home Value: Eligible veterans can refinance their existing mortgages, borrowing up to 100% of their home's appraised value.

Competitive Interest Rates: VA cash-out refinance loans come with highly competitive interest rates compared to other refinancing options, lowering monthly payments and saving money over the life of the loan.

Use Cash for Any Purpose: The cash obtained through refinancing can be used for any purpose, from consolidating debt to home improvements or whatever else you want.

No Monthly Mortgage Insurance Required: Like any VA loan, the cash-out refinance does not require monthly mortgage insurance.