The First Ever 30 Year Fixed in 1934

Key Loan Details

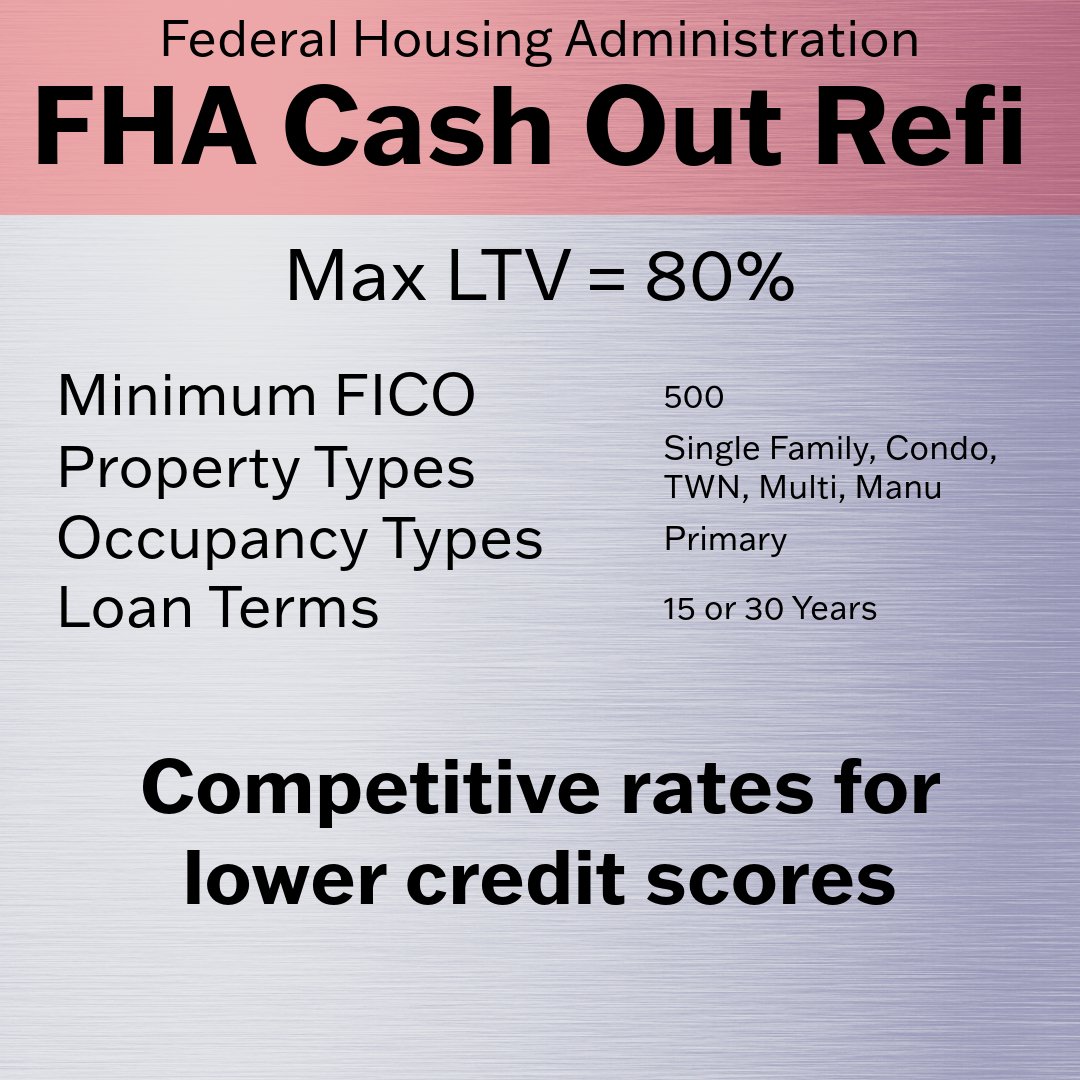

Best Terms for Borrowers With Less Than Perfect Credit: For those with credit scores below 700, an FHA loan may present the most advantageous terms.

Cash Out for Any Reason: Open to all, this option allows for taking as much cash as you want up to 80% of your home’s value. If you’re doing some renovations check out our FHA 203k Program where you can get more than 80% if it’s used for renovations that will increase the value of the property.

Flexible Credit Requirements: Take cash out as long as your credit score is above 500.

FHA Upfront Mortgage Insurance Premium: This fee is added onto your final loan amount so you don’t have to pay it upfront, but it’s not a small fee. The FHA Upfront Mortgage Insurance Premium(UFMIP) is 1.75% of your loan amount. This provides the support needed to maintain the FHA guarantee and is essential for keeping this program going.

Navigating the Application Process

Step 1: Initial Consultation

We Begin with a Conversation: Start off by connecting with us for a detailed discussion about your financial situation and your objectives in refinancing your home. This conversation is crucial to tailoring the refinancing process to your needs. Schedule your consultation now - Book Appointment

Step 2: Application and Analysis

Complete Your Application: Move forward by filling out a formal loan application. We'll be there to guide you every step of the way and inform you about any specific requirements based on your situation. Ready to apply? Apply Online Now

Documents You May Need:

Income Proof: Recent pay stubs, W-2 forms, or tax returns from the last two years to confirm your income and employment.

Asset Verification: Bank statements or other documents to show you have the funds needed for closing costs.

Credit Review: We'll check your credit report, and it's also wise for you to review your credit beforehand.

Property Details: Information about the property you're refinancing, including any sales contract if applicable.

Identification: A valid photo ID to verify your identity.

Additional Income Documentation: Any other relevant documents that prove additional sources of income.

Step 3: Processing and Underwriting Your Loan

Setting Up Your Loan: Once you've decided to proceed, we'll start setting up your loan. This involves structuring your loan, comparing lenders, and reviewing your documents again to ensure everything is in order for a successful outcome. We'll provide detailed information on loan terms, costs, payments, and total cash received at closing.

Automated and Manual Underwriting: Your application will first go through an Automated Underwriting System (AUS) to preliminarily assess your creditworthiness. Following the AUS decision, we'll verify your information and fulfill any document requests. Although automated decisions offer a level of certainty, manual verification is still necessary.

Loan Disclosures: We'll generate your official loan application and related disclosures for electronic signing, guiding you through the process. After these are completed, your file will be prepared for the underwriting stage.

Underwriting Process: Your application and documents will be reviewed by an underwriter to ensure compliance with guidelines and the accuracy of the AUS findings. This stage may require additional communication to address any conditions or questions that arise. We'll keep you updated throughout.

Appraisal: An appraisal will be arranged to evaluate the property's value and ensure it meets the loan program's criteria. This step might occur before or after conditional approval from the underwriter.

Step 4: Final Approval and Closing

Receiving Your Loan Approval: After addressing all underwriting conditions, you'll obtain full loan approval, putting you on the verge of finalizing your refinance.

Clear to Close: With full loan approval, we'll finalize a few remaining details to receive the lender's final clearance. Hearing "clear to close" means we're ready to prepare your closing documents.

Closing Time: During the closing meeting, you'll sign all necessary documents, finalize your loan, and officially complete the refinancing process.